ohio hotel tax calculator

Sections 307672 307695 351021 50556 50557 573908 and 573909. Your average tax rate is 1198 and your marginal tax rate is 22.

Tax Rates Changes Department Of Taxation

Rates range from 0 to 399.

. Maximum Local Sales Tax. Depending on local municipalities the total tax rate can be as high as 8. The calculator will show you the total sales tax amount as well as the county city and.

Use ADPs Ohio Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. So if the room costs 169. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 778 in Hamilton County Ohio. State has no general sales tax. If you make 70000 a year living in the region of Ohio USA you will be taxed 10957.

Average Local State Sales Tax. 15 Tax Calculators. 4 Specific sales tax levied on accommodations.

The tax rate was increased to 4 effective. The Federal or IRS Taxes Are Listed. Maximum Possible Sales Tax.

Lodging taxes are in lieu of a sales. If you make 55000 a year living in the region of. Ohio Income Tax Calculator 2021.

Sections of Ohio Revised Code. You can use our Ohio Sales Tax Calculator to look up sales tax rates in Ohio by address zip code. All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms.

Other local-level tax rates in the state of Ohio are quite complex. Ohio OH Sales Tax Rates by City T The state sales tax rate in Ohio is 5750. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets.

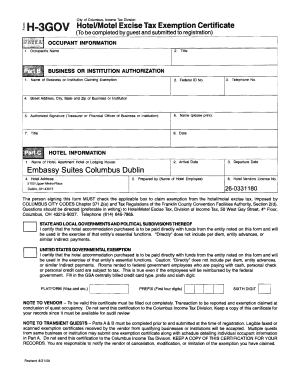

Calculating your Ohio state income tax is similar to the steps we listed on our Federal paycheck calculator. With local taxes the total sales tax rate is between 6500 and 8000. Effective January 1 1969 the City of Columbus implemented a 3 tax on the room rental income of hotelsmotels located in Columbus Ohio.

Ohio Hotel Tax Calculator. Ohio has recent rate. Ohio has a progressive income tax system with six tax brackets.

The Ohio Income Taxes Estimator. Just enter the wages tax withholdings and other information required. The Ohio Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year.

The Ohio OH state sales tax rate is currently 575. Forms The collection of Lucas County HotelMotel lodging tax as permitted by Chapter 5739 of the Ohio Revised Code is coordinated by the Office of Management and BudgetThe local rule. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

Sports and a 1 percent municipal hotel tax. So the tax year 2022 will start from July 01 2021 to June 30 2022. Only In Your State.

For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. Ohio State Sales Tax. Sales Tax Table For Hamilton County Ohio.

The state income tax system in Ohio is a progressive tax system.

Preview W Va Property Tax Amendment On November Ballot Wvpb

Ohio Offers Covid 19 Relief With Four Grant Programs

How Tax Friendly Is Your State Moneygeek Moneygeek Com

Sales Tax Calculator And Rate Lookup Tool Avalara

Sales Tax Calculator And Rate Lookup Tool Avalara

States With The Highest Lowest Tax Rates

Does Ohio Charge Sales Tax On Services Taxjar

States With The Highest Lowest Tax Rates

Ohio Income Tax Calculator Smartasset

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

Ohio Municipal Income Tax Reform Its Impact On Realtors

Sales Taxes In The United States Wikipedia

Arizona Sales Tax Small Business Guide Truic

![]()

3 Simple Steps To Documenting Tax Exempt Sales And Avoiding Liability

Ohio State Tax Tables 2020 Us Icalculator

States With The Highest Lowest Tax Rates

Ohio Hotel Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow